How to identify Fake New Naira Notes

With the announcement of the new redesigns of the Naira Notes, there has been a high-end tension in almost every part of the country because the new naira notes can easily be faked, and in fact, the fake ones are more in circulation almost than the new ones. Here is how to identify fake new naira notes.

The reasons for the fake new naira notes are not far-fetched:

- The new naira notes appear to be washing off when water is poured

- The redesigns are not as authentic as the old naira notes

- Not many people know what the new naira notes look like so it may be hard to identify fake new naira notes.

Here is how to identify Fake New Naira Notes

How to Identify Fake New Naira Notes

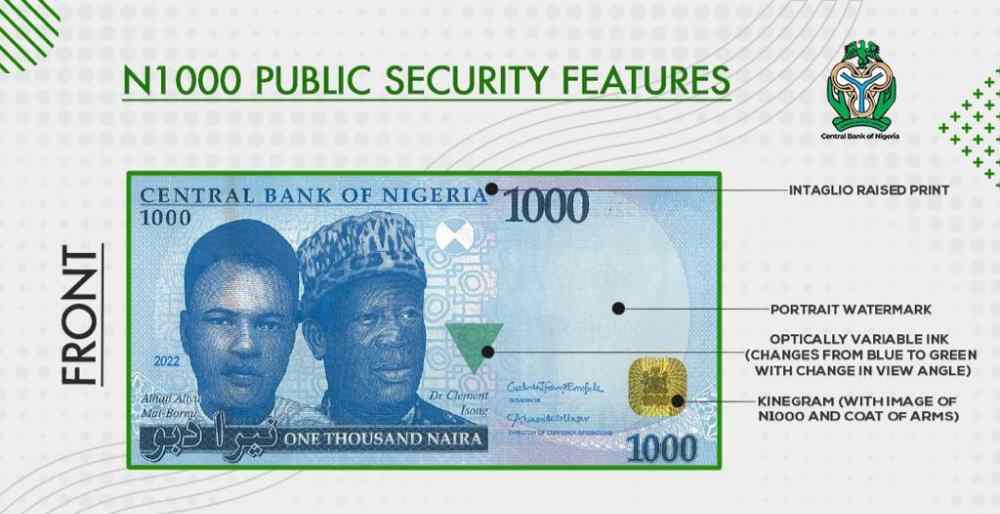

The best way to identify fake new naira notes is to go through the public security features as laid down by the Central Bank of Nigeria. Here are the best ways to identify Fake New Naira Notes according to CBN (Central Bank of Nigeria)

- Portrait watermark

- CBN Watermark

- Silver patch (Antiscan)

- See through (Printing in Register)

- Optically variable ink

- Windowed Metallic Security Thread

- Hand engraved Portrait

- Raised Intaglio Print

- Kinegram

- Iridescent Band

We are going to explain how these features are applicable in identifying Fake New Naira Notes; especially the #500 and #1,000 notes.

How to Identify #500 Fake New Naira Notes

Optically Variable Ink

You first need to check for the optically variable ink used to write the “500” on the note. By optically variable, it means it can change from blue to green based on the angle you view it from. If it doesn’t change from Blue to Green when the view angle is changed, then it is definitely a fake #500 notes.

“Bala Blu Bulaba” Meaning? Tinubu to Owerri Residents

See-through printing and Silver Patch

Also, check if the see-through printing imprinted right beside the air of the Nnamdi Azikwe hand-engraved portrait is there. Right under the see-through printing is the silver patch that rests on the shoulder of the Nnamdi Azikwe engraved portrait.

Windowed Metallic Security Thread

Most importantly, you want to check for the windowed metallic security thread. This is a line of rectangular-like blocks that divides the #500 notes into two. They have the CBN inscription on them.

Watermark

There is a portrait and CBN watermark on the sides of the #500 notes which can easily be used to distinguish it and identify fake new naira notes.

How to Identify #1,000 Fake New Naira Notes

Optically variable Ink

Just like the #500 Naira note, the #1,000 note has an optically variable ink embedded on the triangle in front of the #1,000 notes. When you change the view angle of the note, that triangle changes from blue to green and vice versa. If the #1,000 new notes you have shows none of these features, then there is a tendency that it is a fake new naira note. But before we decide, let’s check the most important determiner- The Kinegram.

“Far From Home” Netflix Cast| Let’s Meet Them!

The Kinegram

The Kinegram is a gold imprint on the front of the #1000 new naira note that has the image of #1,000 and the coat of arms on it. To identify a fake new naira note- the #1,000 notes in this instance, it has to have the Kinegram. If it doesn’t, it is definitely a fake #1000 notes.

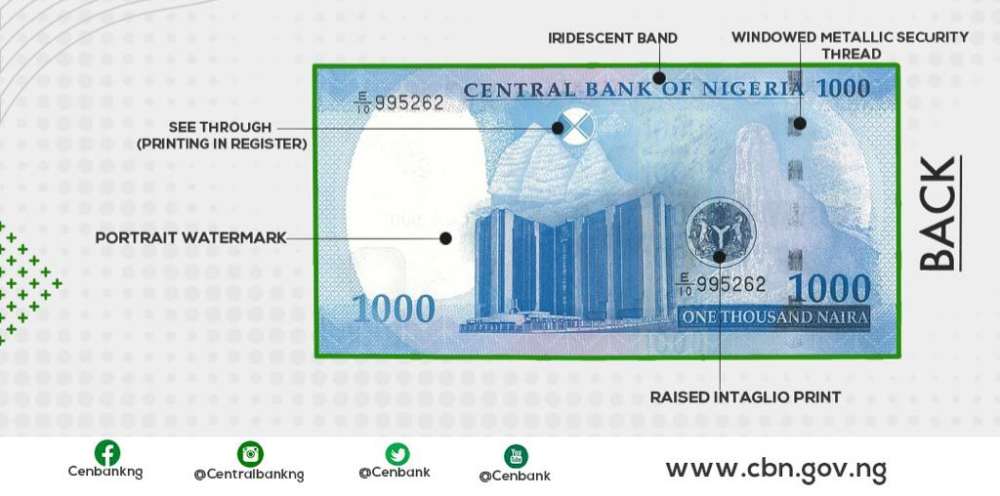

Windowed Metallic Security Thread

Unlike the #500 new notes, the 1,000 note has its windowed metallic security thread at the back. As described, is a line of rectangular-like blocks that divides the #1000 notes into two.

These are the major ways to identify fake new naira notes

How to Identify Fake New Naira Notes

- Portrait watermark

- CBN Watermark

- Silver patch (Antiscan)

- See through (Printing in Register)

- Optically variable ink

- Windowed Metallic Security Thread

- Hand engraved Portrait

- Raised Intaglio Print

- Kinegram

- Iridescent Band

Go to Home

The Best 2022 Nigerian Albums so far {Ranked}

About CBN

The Central Bank of Nigeria (CBN) is the central bank and apex monetary authority of Nigeria established by the CBN Act of 1958 and commenced operations on 1 July 1959.

The major regulatory objectives of the bank as stated in the CBN Act are to: maintain the external reserves of the country, promote monetary stability and a sound financial environment, and act as a banker of last resort and financial adviser to the federal government

The central bank’s role as lender of last resort and adviser to the federal government has sometimes pushed it into murky regulatory waters.

After the end of imperial rule the desire of the government to become pro-active in the development of the economy became visible especially after the end of the Nigerian civil war, the bank followed the government’s desire and took a determined effort to supplement any show shortfalls, credit allocations to the real sector.

The bank became involved in lending directly to consumers, contravening its original intention to work through commercial banks in activities involving consumer lending.

However, the policy was an offspring of the indigenization policy at the time. Nevertheless, the government through the central bank has been actively involved in building the nation’s money and equity centers, forming securities regulatory boards, and introducing treasury instruments into the capital market.

The bank has thirty-six branches each in the 36 states of the federation and the headquarters in FCT

The Central Bank was instrumental in the growth and financial credibility of Nigerian commercial banks by making sure that all the financial banks operating in the country had a capital base (required reserves).

This helped to ensure that bank customers just did not bear losses alone, in the event of bank failures.

However, this policy led to the failure of some Nigerian commercial banks; some banks could not meet up with the new capital base requirements, which was 25,000,000,000.00 Naira at the time.

Those banks that could not meet the new capital base requirements had to fold up, while some that could not come up with the money on their own, had to merge with other banks in order to raise the money.

This policy helped solidify the commercial banks of Nigeria, and made it impossible for individuals or organizations without financial stability to operate a bank in the country.

Today Nigeria has one of the most advanced financial sectors in Africa, with most of its commercial banks having branches in other countries.